VERISIGN INC/CA (VRSN)·Q4 2025 Earnings Summary

VeriSign Q4 2025: Revenue Beats on Domain Strength, EPS Misses as Costs Rise

February 5, 2026 · by Fintool AI Agent

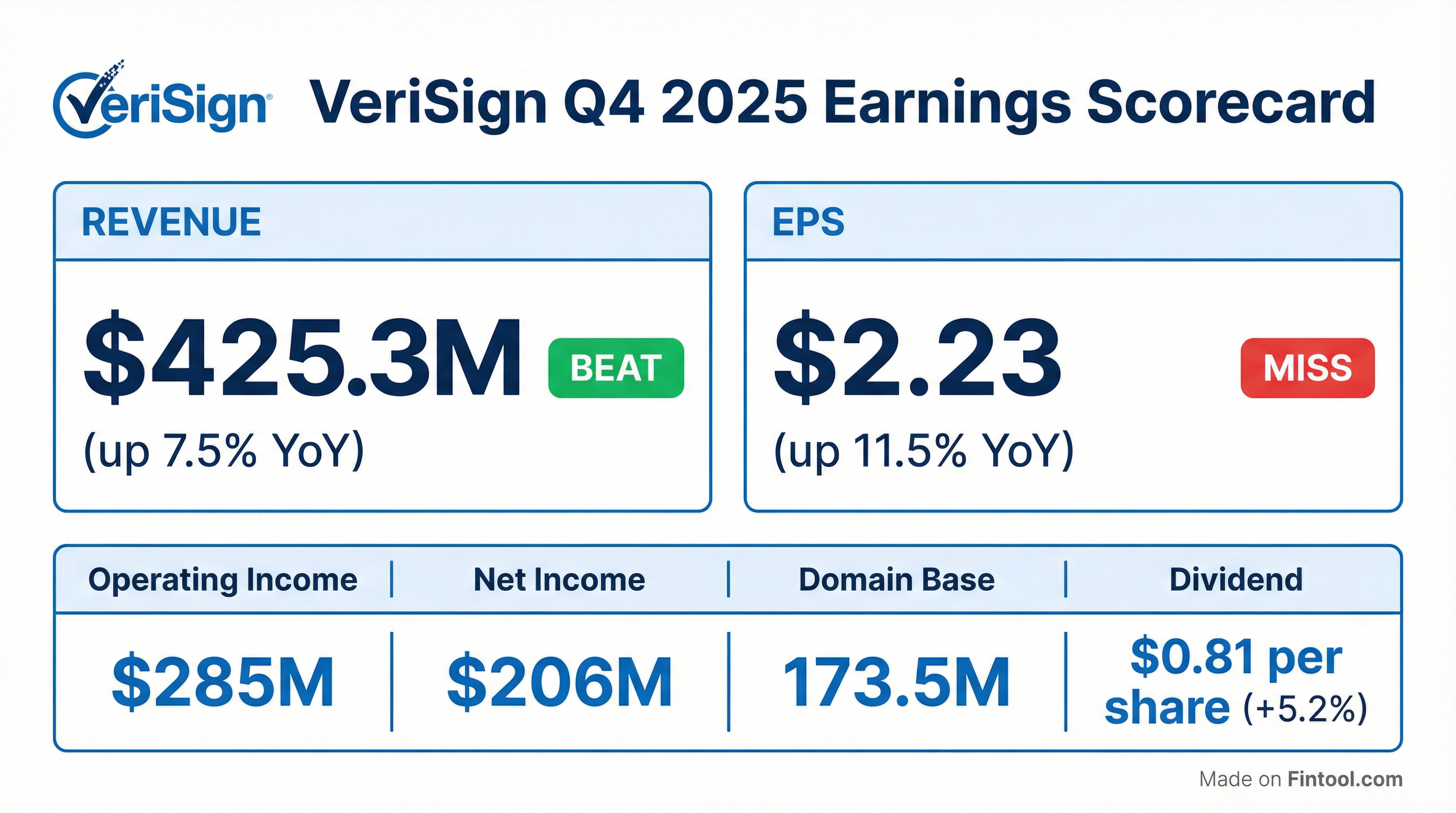

VeriSign reported Q4 2025 results with a mixed outcome: revenue beat consensus by 0.3% on strong domain registrations, but EPS missed by 2.6% as operating expenses grew faster than revenue. The company announced a 5.2% dividend increase and extended its 28-year streak of 100% DNS availability.

Did VeriSign Beat Earnings?

Revenue: Beat by +0.3% — VeriSign posted Q4 2025 revenue of $425.3M vs. the $424.0M consensus estimate, driven by continued growth in .com and .net registrations. Revenue grew 7.5% YoY compared to $395.4M in Q4 2024.

EPS: Missed by -2.6% — Diluted EPS of $2.23 came in below the $2.29 consensus. While EPS grew 11.5% YoY from $2.00 in Q4 2024, higher selling, general and administrative expenses (+11.5% YoY to $65.0M) and research and development costs (+6.4% YoY to $26.5M) compressed the beat relative to expectations.

Revenue and EPS consensus from S&P Global. Financial data from 8-K.

What Did Management Guide?

VeriSign provided FY 2026 guidance that implies mid-single digit growth continuation:

Guidance takeaways:

- Revenue guidance midpoint of $1.725B implies ~4% YoY growth, slightly below FY 2025's 6.4% growth rate

- Domain base growth of +1.5% to +3.5% is consistent with recent trends but conservatively wide

- Higher capex ($55-65M vs $23M) suggests infrastructure investments planned for 2026

- Operating margin guidance implies 67.5-68.0% range, roughly flat with 2025's 67.5%

How Did the Stock React?

VeriSign shares closed at $242.62 on February 5, 2026, essentially flat (-0.01%) on the day of the earnings release. The muted reaction reflects the offsetting dynamics of the revenue beat and EPS miss.

Stock Performance Context:

- YTD 2026: +0.9%

- 52-Week Range: $216.43 - $310.60

- Current vs. 52-Week High: -21.9% below the high

The stock has been range-bound since retreating from its 52-week high of $310.60. VeriSign has now missed EPS estimates in two of the last five quarters (Q4 2024 and Q4 2025), though it has beaten revenue estimates consistently.

What Changed From Last Quarter?

Positive developments:

-

Accelerating domain growth — New .com/.net registrations of 10.7M in Q4 vs. 9.5M in Q4 2024 (+12.6% YoY), signaling robust demand for internet infrastructure.

-

Improved renewal rates — Q3 2025 final renewal rate of 75.4% vs. 72.2% in Q3 2024, indicating better customer retention.

-

Cash flow acceleration — Q4 cash from operations of $290M vs. $232M in Q4 2024 (+25.0% YoY). Full year 2025 operating cash flow of $1.09B vs. $903M in 2024 (+20.8%).

-

Dividend increase — Board approved 5.2% dividend increase to $0.81/share quarterly, demonstrating confidence in cash generation.

Areas to watch:

-

Rising expenses — SG&A expenses grew 11.5% YoY while revenue grew 7.5%, compressing operating leverage. R&D also grew faster than revenue at 6.4%.

-

Stock below 52-week high — Despite solid fundamentals, shares are trading 22% below their 2025 peak, suggesting valuation concerns or sector rotation.

Full Year 2025 Performance

VeriSign delivered strong full-year results, with revenue of $1.66B (+6.4% YoY) and EPS of $8.81 (+10.1% YoY).

The EPS growth outpacing net income growth reflects the continued share buyback program — VeriSign repurchased 3.4M shares for $859M in 2025, reducing diluted shares outstanding from 98.2M to 93.8M.

Capital Allocation

VeriSign returned over $1.1B to shareholders in 2025 through buybacks and dividends:

The company ended 2025 with $581M in cash, cash equivalents, and marketable securities, down $19M from year-end 2024. Deferred revenues (a proxy for future contracted revenue) increased $80M to $1.38B, providing visibility into 2026.

Key Business Metrics

VeriSign's 28-year track record of 100% availability for .com and .net DNS resolution remains a core competitive moat, underpinning its dominant position in internet infrastructure.

Management Commentary

"2025 marked another solid year for Verisign as we continued to deliver on our mission by extending our record of 100% service delivery for the .com and .net DNS to an unparalleled 28 years, even as utilization of our services increased significantly."

— Jim Bidzos, Executive Chairman and CEO

"Internet use is growing, traffic is expanding. We believe with confidence that a good portion of that is due to AI, and AI is benefiting us... in several different ways."

— Jim Bidzos, on AI tailwinds

"We're pleased with the progress we made during 2025 and look forward to delivering on our mission during 2026... We now believe we have strong candidates for new services that can help reduce known and unknown vulnerabilities and contribute significantly to information trust."

— Jim Bidzos, on new product initiatives

Historical Quarterly Trend

EPS data from S&P Global. Gross margin from quarterly filings.

Revenue has grown sequentially for 8 consecutive quarters, though Q4 EPS showed sequential compression due to seasonally higher expenses.

Forward Catalysts

-

.com pricing decision in April — VeriSign can raise prices up to 7% annually in the back four years of each six-year period. The first available increase is end of October 2026, requiring a 6-month notice (April announcement). Any price hike would flow directly to revenue given the ~75% renewal rate.

-

New security services — Management teased "strong candidates for new services that can help reduce known and unknown vulnerabilities" — the first new product hints since 2015 divestitures. Details expected in coming months.

-

AI-driven DNS utilization — LLMs scraping the web and agentic AI navigating the internet are increasing DNS queries. This structural tailwind increases infrastructure value and could support domain pricing.

-

Continued domain growth — New registrations of 10.7M in Q4 (+12.6% YoY) and improved renewal rates support domain base expansion.

-

Share repurchase capacity — $1.08B remaining authorization provides ongoing EPS accretion potential.

-

ICANN gTLD round — New application window opens April 2026. VeriSign holds .web from the prior round and may pursue opportunities aligned with critical infrastructure.

Q&A Highlights

On AI Driving Domain Growth:

CEO Jim Bidzos provided detailed commentary on how AI is benefiting the business through multiple channels:

"AIs building LLMs are... basically scraping the internet and collecting data. We see that in the increase in our queries. That's an indication that there's increased activity and traffic. No doubt, a portion that we find difficult to measure with precision, but no doubt that a portion of that is AI... Agentic AIs, obviously, conducting multiple tasks for people, are going to have to navigate. They're gonna have to refresh data, collect current data. They're going to be using the DNS to do that."

On Marketing Program Success:

Management attributed part of the domain resurgence to revamped registrar programs:

"One of the most significant changes that we made was simply giving this evolving, changing channel the flexibility to choose from a basket of programs that we began to provide. That allowed them to engage in the ones that are most effective for them."

On New Services in Development:

Bidzos teased potential new offerings for the first time in years:

"We now believe we have strong candidates for new services that can help reduce known and unknown vulnerabilities and contribute significantly to information trust. These potential new services are strongly aligned with our core mission, leverage our long history of pioneering DNS and security technology, and can be offered to new or existing customers throughout our channel. We'll share more in the coming months."

On Pricing:

When asked about .com price increases, management clarified the timeline:

"We do have the ability to raise prices in every six-year period in the back four years, 7%, each of those back four years. It requires six months notice. The first available price increase will come at the end of October of 2026, and therefore, if we choose to execute some level of a price increase, the first opportunity to take advantage of that would be an announcement made in April."

On Higher Capex Guidance:

CFO John Calys explained the elevated 2026 capex:

"First, we have a larger amount of end-of-life equipment that we are replacing in 2026, along with planned capacity expansion, both of which are facing significantly higher costs, largely attributable to intense AI industry driven demand and supply constraints. Additionally, we are planning a few capital improvement projects to our corporate headquarters."

On ICANN's New gTLD Round:

ICANN is opening a new gTLD application round in April 2026. VeriSign holds .com, .net, and has an interest in .web from the prior round. Management indicated they are "studying it" for opportunities consistent with their role as critical infrastructure.

Risks to Monitor

- Rising expense growth — SG&A and R&D growing faster than revenue could compress margins over time

- Macro sensitivity — Domain registration growth correlates with small business formation and economic activity

- Regulatory changes — Any modifications to the .com Registry Agreement could impact pricing power

- First-time renewal headwind — Higher mix of first-time renewals in 2026 could pull down overall renewal rates

Sources: VeriSign 8-K filed February 5, 2026 . Earnings call transcript February 5, 2026 . Consensus estimates from S&P Global.